If you choose a $2,000 Medical Cost Limitation, each passenger will have up to $2,000 protection for medical claims resulting from a crash in your lorry. If you are entailed in an accident as well as the other chauffeur is at mistake but has also little or no insurance policy, this covers the gap between your costs and also the various other chauffeur's protection, approximately the restrictions of your coverage (affordable).

The limitations required and optional restrictions that may be offered are established by state legislation. This coverage, needed by legislation in some states, covers your clinical prices as well as those of your passengers, no matter that was accountable for the crash. The limits needed as well as optional restrictions that might be available are established by state regulation (insurance).

The money we make aids us offer you accessibility to cost-free credit rating and reports and aids us create our various other excellent tools and instructional products (business insurance). Compensation might factor right into how and where items show up on our system (and in what order). But given that we normally earn money when you discover a deal you like and also get, we try to reveal you uses we think are a good suit for you.

If you like to assess insurance coverage options with a person, functioning with a vehicle insurance coverage agent is an additional means to go. It's not simply your driving document that figures out the insurance coverage quotes you get.

Acceptable Proof Of Insurance - Georgia Department Of Revenue for Dummies

They utilize claims information and also personal info, amongst other factors, to evaluate this danger. In some states, your debt can have some influence on your premium (though The golden state, Massachusetts as well as Hawaii have actually all prohibited the practice of using credit-based insurance ratings to aid determine prices) (insurers). As well as while it's somewhat questionable, the usage of credit-based insurance policy ratings to influence costs expense is still a fact, with researches as well as studies suggesting that those with less-than-ideal debt are a lot more most likely to make insurance coverage claims and also the other way around.

a 2015 Consumer Records survey shows that single participants with just "great" credit history paid as a lot as a tremendous $526 even more a year (relying on their state) than comparable drivers with the very best credit rating. Along with credit rating, your insurance https://car-insurance-south-houston-tx.s3.mon01.cloud-object-storage.appdomain.cloud policy prices might likewise be affected by the following variables: Particular locations have higher-than-normal prices of accidents and also vehicle burglary.

The a lot more costly your auto is, the greater your insurance coverage rates might be. Insurance firms can also consider whether chauffeurs with the very same make as well as design have a tendency to file more cases or be in even more accidents, along with safety examination results, expense of repair work and theft price. Putting fewer miles on your cars and truck monthly can impact the prices you get.

vans car credit cheaper

vans car credit cheaper

Information shows that the likelihood of a mishap may be linked to these elements - cheapest car. Obligation insurance typically includes three types of coverage: physical injury responsibility protection, property damage obligation insurance as well as without insurance driver insurance coverage. Each state that needs obligation insurance policy has its own minimum coverage requirement, yet you can choose extra protection at a price. However before you choose your state's minimum protection need, think about any kind of assets, such as your home, savings or investments. They might all be at threat if you create a mishap that leads to clinical or building damage prices that surpass your protection limit. You may wish to choose protection limits that, at minimum, mirror the worth of your mixed assets.

Fascination About Auto-insurance-guide.pdf

He delights in supplying readers with information that can make their lives happier and also extra expansive - cheapest car. Warren holds a Bac Find out more. Learn more.

In these states, fault is not relevant in determining who need to spend for physical injury obligation after a crash. Personal injury damages are covered by your very own insurance firm, no matter who is at fault for a mishap. No-fault states still need vehicle drivers to acquire building damage responsibility, and several also require that you carry physical injury obligation protection also.

This choice is made when you acquisition or restore your cars and truck insurance policy. What obligation car insurance coverage does not cover Responsibility automobile insurance does not cover problems to your very own car and person after a mishap. If you want your insurer to cover these problems, you will need crash and also clinical insurance coverage.

Liability coverage will not spend for home problems and also medical costs for the various other driver if you are not to blame (insured car).

The Facts About Proof Of Insurance Explained – Forbes Advisor Revealed

The average automobile insurance coverage price for complete protection in the United States is $1,150 per year, or regarding $97 each month. No insurance plan can cover you as well as your auto in every scenario. A 'full insurance coverage automobile insurance coverage' plan covers you in most of them. Complete insurance coverage insurance policy is shorthand for cars and truck insurance policy policies that cover not just your obligation but damage to your car also.

A complete protection plan depending on state regulations might likewise cover without insurance vehicle driver insurance coverage as well as a clinical insurance coverage of injury protection or medical payments. A typical full insurance coverage insurance coverage will certainly not cover you as well as your automobile in every circumstance. It has exclusions to details events. IN THIS ARTICLEWhat is full protection auto insurance coverage? There is no such thing as a "complete insurance coverage" insurance plan; it is just a term that refers to a collection of insurance coverage protections that not only includes obligation coverage but collision and detailed.

What is taken into consideration full insurance coverage insurance coverage to one chauffeur may not be the very same as even one more chauffeur in the exact same house. Ideally, complete insurance coverage indicates you have insurance policy in the kinds as well as quantities that are proper for your earnings, assets and take the chance of account. The factor of all types of cars and truck insurance policy is to maintain you from being economically spoiled by a mishap or case.

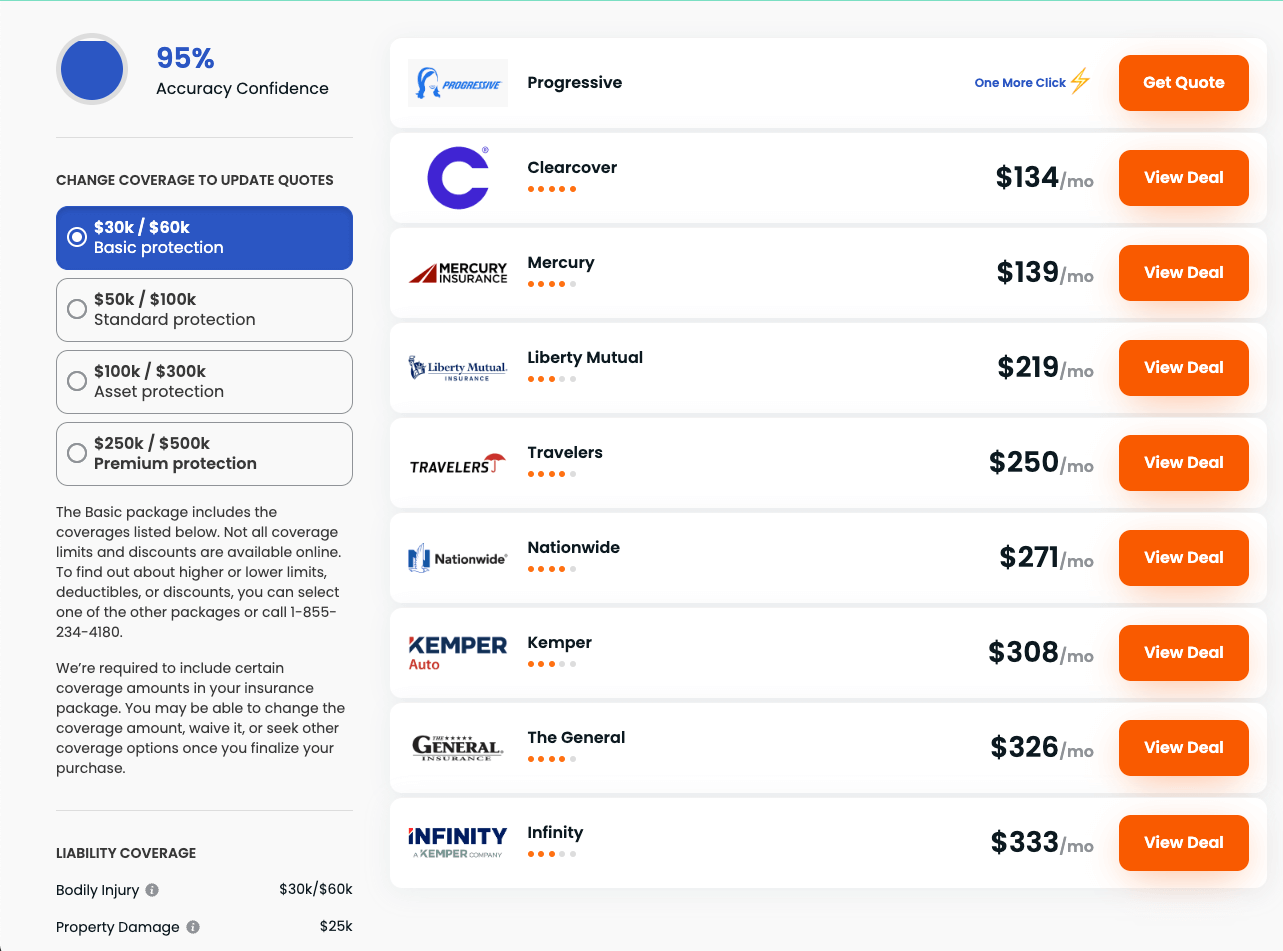

Fees additionally differ by hundreds and even countless bucks from business to firm - low-cost auto insurance. That's why we always recommend, as your primary step to conserving money, that you compare quotes. Below's a state-by-state comparison of the typical annual cost of the adhering to coverage levels: State-mandated minimal liability, or, simplistic protection needed to legally drive an automobile, Complete insurance coverage responsibility of $100,000 per person wounded in a crash you cause, approximately $300,000 per crash, and $100,000 for residential property damages you create (100/300/100), with a $500 insurance deductible for comprehensive as well as collision, You'll see just how much complete insurance coverage vehicle insurance coverage prices per month, and every year.

An Unbiased View of About Car Insurance Coverage Types - Liberty Mutual

The average annual price for complete insurance coverage with greater liability limits of 100/300/100 is around $1,150 greater than a bare minimum policy. If you choose reduced liability limitations, such as 50/100/50, you can conserve yet still have decent defense. car insurance. The typical month-to-month cost to boost coverage from state minimum to full protection (with 100/300/100 restrictions) has to do with $97, yet in some states it's a lot less, in others you'll pay even more. business insurance.

Your cars and truck, as much as its reasonable market price, minus your insurance deductible, if you are at fault or the other motorist does not have insurance policy or if it is damaged by a natural calamity or swiped (compensation and accident)Your injuries as well as of your guests, if you are hit by a without insurance driver, approximately the restrictions of your uninsured driver plan (uninsured motorist or ).

prices insurance low cost car

prices insurance low cost car

As a matter of fact, full protection car insurance coverage have exemptions to specific events. Each full cover insurance plan will certainly have a listing of exclusions, suggesting products it will certainly not cover. Racing or various other speed competitions, Off-road usage, Usage in a car-sharing program, Catastrophes such as battle or nuclear contamination, Damage or confiscation by government or civil authorities, Using your car for livery or shipment objectives; company use, Deliberate damage, Cold, Damage, Mechanical breakdown (typically an optional insurance coverage)Tire damages, Items taken from the auto (those may be covered by your home owners or occupants policy, if you have one)A rental car while your own is being repaired (an optional protection)Electronics that aren't permanently connected, Custom parts and devices (some percentage may be specified in the policy, however you can typically include a cyclist for higher amounts)Do I require full insurance coverage cars and truck insurance? You're called for to have liability insurance policy or a few other proof of financial responsibility in every state.

cheap insurance low-cost auto insurance low cost auto cheap insurance

cheap insurance low-cost auto insurance low cost auto cheap insurance

You, as a car proprietor, get on the hook personally for any type of injury or residential property damage beyond the limitations you picked. insurers. Your insurance company won't pay greater than your restriction. But liability protection won't pay to fix or replace your automobile. If you owe cash on your automobile, your lending institution will certainly require that you acquire crash and also comprehensive protection to protect its investment.

What Is A Good Car Insurance Policy? - Moneyhelper - The Facts

Here are some general rules on insuring any kind of automobile: When the vehicle is brand-new and also financed, you have to have complete insurance coverage. Keep your insurance deductible manageable - car. When the auto is repaid, increase your deductible to match your available financial savings. (Greater deductibles help decrease your costs)When you get to a point financially where you can replace your auto without the help of insurance policy, seriously take into consideration dropping comprehensive and also collision.

Here are a few ideas to adhere to when buying affordable complete insurance coverage car insurance policy: See to it you are constant when shopping your liability limitations. If you choose in physical injury responsibility per person, in physical injury responsibility per crash and in property damage liability per crash, constantly go shopping the exact same coverage levels with other insurers (auto insurance).

These insurance coverages belong to a complete protection bundle, so a costs quote will certainly be essential for these protections too - cheapest car. Both accident as well as extensive featured a deductible, so make certain constantly to choose the very same deductible when looking for coverage. Selecting a higher insurance deductible will push your premium lower, while a reduced deductible will certainly result in a higher costs.

There are various other insurance coverages that assist comprise a full coverage plan - cheap. These coverages vary however can include: Uninsured/underinsured driver protection, Personal injury security, Rental reimbursement protection, Towing, Space insurance, If you require any of these added coverages, always select the exact same coverage degrees and deductibles (if they use), so you are contrasting apples to apples when looking for a brand-new policy.

Getting My Auto Insurance Basics To Work

cheap insurance business insurance cheap car low-cost auto insurance

cheap insurance business insurance cheap car low-cost auto insurance

Can I drop complete insurance coverage auto insurance? If you can manage such a loss-- that is, replace a swiped or amounted to cars and truck without a payment from insurance coverage-- do the mathematics on the prospective cost savings as well as think about going down protections that no longer make feeling.

Going down detailed and also collision, she would certainly pay about a year a cost savings of a year. Let's say her vehicle deserves as the "real cash worth" an insurer would pay. If her vehicle were completed tomorrow and also she still carried complete protection, she would get a check for the car's actual cash money worth minus her insurance deductible.

Of program, the cars and truck's worth goes down with each passing year, and so do the insurance policy premiums - suvs. Full coverage cars and truck insurance policy FAQ's, Exactly how much is complete protection insurance policy on a brand-new automobile?