The New York City Division of Motor Autos (DMV) has a system, called the Insurance coverage Information and Enforcement System (IIES), that discovers uninsured cars. cheaper cars. Insurance firms are needed to report to the DMV info, such as cancellations, renewals, and also issuance of brand-new plans, on all persons they insure for automobile insurance.

Failing to maintain liability insurance policy protection for your automobile whatsoever times can lead to the suspension of your vehicle registration as well as chauffeur's permit, along with other significant monetary charges. These procedures can lead to you getting a letter from the DMV asking about your insurance coverage status also if your automobile is presently guaranteed.

Call your insurance policy representative, broker or business for aid in replying to these letters, or call the DMV straight for details on exactly how to deal with such correspondence. Cars and truck rental arrangements vary from one auto rental business to one more - affordable. All vehicle rental business need to offer the minimal protections needed by regulation.

For rentals of 30 successive days or much less, cars and truck rental business in New york city State can market CDW, or, if not acquired, bill an occupant for the total value of a taken (lost) or harmed rental car. The everyday price of the CDW might be as high as $12, relying on the worth of the automobile - dui.

Today such coverage is presently given without any type of extra fee. Additionally, numerous charge card firms also supply some kind of "accident damages protection" to their cardholders for cars they rent with that card. This is different from any kind of other coverage and generally covers losses just over of amounts collectible under various other existing protections.

When a Motor Car is to be Fixed Insurer do not need to work out an insurance claim based on the highest estimate of repair work - credit. If a firm believes the price quotes are also high, they can consult other fixing facilities. The insurer's offer needs to cover the real repair service expenses to recover the harmed motor lorry to pre-loss condition.

The Best Strategy To Use For Personal Auto Insurance Overview - Florida Department Of ...

We suggest you enter writing from your insurer and/or agent/agency that your insurance policy coverage under your individual plan of insurance coverage reaches cover required liability insurance coverage defense while you are operating a rental car. Otherwise, we suggest you acquire such expanded responsibility insurance security from your insurer or from the rental vehicle company.

Automobile Mishap List Being included in an automobile mishap can leave you really feeling perplexed, trembled, angry, or scared. cheaper cars. There are some points you can do at the crash scene to help you obtain an insurance claim processed correctly. We suggest you keep this list in the handwear cover area of your car(s) to assist you should you ever before be associated with an automobile mishap.

Supply copies of paperwork you need to sustain your case. State what has been done to fix your trouble including who you have actually spoken with and what you were told. Maintain a copy of your letter to the Kansas Insurance policy Division for reference. While the Kansas Insurance coverage Department has actually recouped numerous dollars for Kansas customers, the Division can not compel any type of insurance company to pay a case if the company, in excellent faith, thinks as a matter of regulation or fact, that it does not owe the cash in concern.

Any vehicle with a present Florida registration must: be guaranteed with PIP and also PDL insurance at the time of lorry registration. have an Automobiles signed up as taxis have to carry bodily injury obligation (BIL) coverage of $125,000 per person, $250,000 per occurrence and also $50,000 for (PDL) insurance coverage. have constant insurance coverage even if the lorry is not being driven or is inoperable (accident).

You must obtain the enrollment certification and certificate plate within 10 days after starting work or registration. You need to likewise have a Florida certification of title for your lorry unless an out-of-state lien holder/lessor holds the title and will not release it to Florida. Relocating Out of State Do not terminate your Florida insurance coverage till you have registered your car(s) in the other state or have surrendered all valid plates/registrations to a Florida.

Penalties You should preserve required insurance coverage throughout the registration period or your driving opportunity and also license plate might be put on hold for as much as 3 years. There are no arrangements for a momentary or difficulty motorist permit for insurance-related suspensions. Failing to keep necessary insurance policy coverage in Florida may cause the suspension of your vehicle driver license/registration and also a need to pay a reinstatement charge of approximately $500.

8 Simple Techniques For Mandatory Insurance Brochure - Illinois Secretary Of State

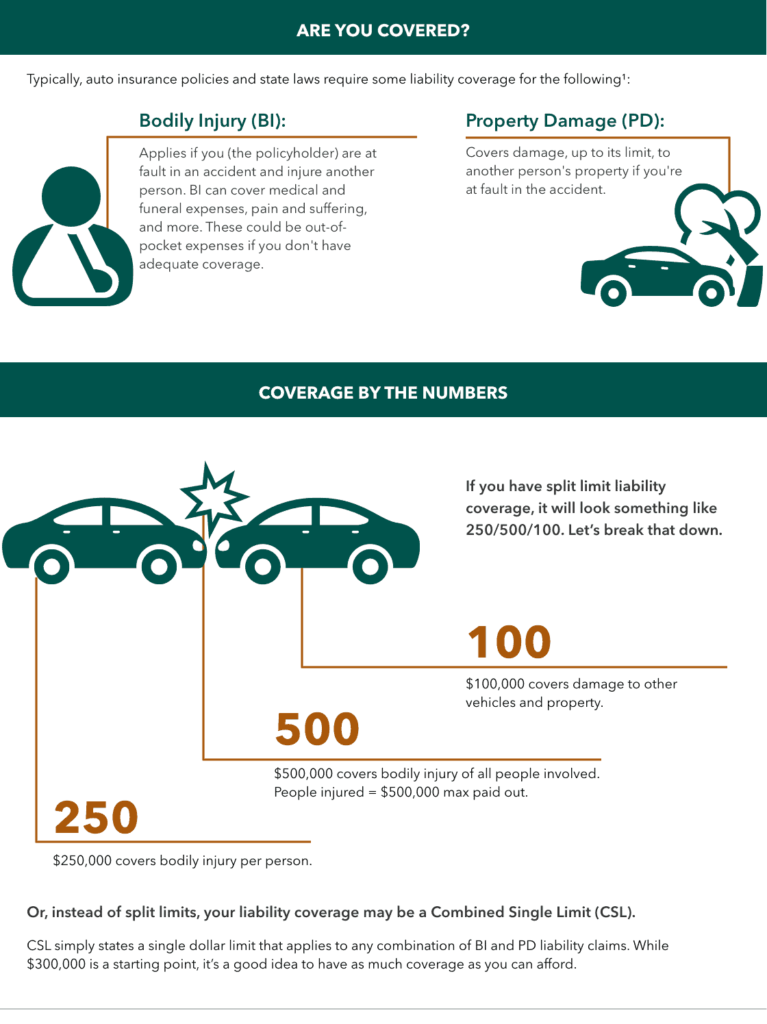

happens when an at-fault event is sued in a civil court for problems created in a car crash as well as has not completely satisfied property damages and/or bodily injury requirements. (PIP) covers you regardless of whether you are at-fault in an accident, approximately the limitations of your policy. (PDL) spends for the damages to other individuals's building. cheap auto insurance.

You might request termination, yet the company is qualified to made premium. Do not pay, and also the business will cancel your plan for nonpayment of premium. The manufacturer must be able to give you an adequate explanation for the increase in your costs. credit. If you really feel that your costs was intentionally priced estimate reduced in order to get your service, you need to file a Ask for Assistance with the Division.

A (suvs). Yes, as long as the repairs recover the car to its worth which existed before the loss. The parts used do not always have to be original tools manufacturer (OEM) components, but ought to be of like kind as well as high quality as the parts being replaced. Ask your company regarding what guarantees they will certainly give you on these components.

You have two choices: You may sue with the at-fault event's insurance provider if they are insured, or if you have accident insurance on your automobile, you can have your very own insurer pay for the problems, and also they will typically subrogate versus the at-fault party to recuperate their loss.

Insurer are obliged to pay based on their policy arrangements, which is usually the actual cash money value of the lorry at the time of the loss. insure. This quantity does not constantly cover the finance balance since you may owe more than the automobile is really worth. The debtor of the lending is in charge of paying the difference to the banks.

A. The firm is bound to pay claims for which the insured is lawfully liable, as a result of an accident. The reality that the insured did not report the accident shows up to be unimportant, as long as sufficient documentation confirming the claim can be provided to the company. A. When the damage to a car is equal to or greater than 75% of the value of the automobile, it can be thought about a total loss.

The smart Trick of Understanding Auto Insurance That Nobody is Discussing

Vehicle Policy Security Car plans typically offer the following kinds of protection: Physical Injury Obligation: Pays, as much as the limitations of the policy, for injuries to other individuals you create with your cars and truck - suvs. Home Damage Obligation: Pays, approximately the limits of the policy, for damages to various other individuals's residential property brought on by your auto.

It will pay for damages to your vehicle caused by accident or upset. Comprehensive: Pays for problems to your automobile created by perils various other then collision or distress. Other: There are various other coverage's such as towing and car leasing which might be offered.

Companies must file their prices and also kinds with us prior to they are carried out. If the rates are fair, ample, and also not excessive or unjustly prejudiced, the firms may utilize them. This allows competitors to exist as well as allows Indiana people to acquire insurance at a fair cost. The prices are open for public examination.

When contrasting costs, be certain each business is pricing quote on the exact same basis. The least expensive plan is not always the most effective plan. Some score factors insurer may make use of are: Age and Sex Marital Status Motorist Record Auto Usage Area of House Policy Limits Deductibles Kind Of Auto Chauffeur Educating Insurance Claims Background Credit Rating Cancellation or Non-Renewal Constraints Insurer have to adhere to specific guidelines to cancel or non-renew an insurance policy in Indiana.

Look for an accredited insurance coverage representative (insurance coverage manufacturer) that is reputable as well as useful in answering your concerns. You need to shop around for the finest insurance coverage product at the best rate.

Pays for a new lorry if the expense to fix your automobile is greater than the worth of a brand-new automobile. The endorsement is generally offered just during the first three version years. Pays a particular amount each day (e. g. $15) to rent out a lorry while yours is being repaired as a result of a protected loss - suvs.

Not known Details About Automobile Insurance - Official Website

Some elements business use to establish the expense consist of: Stats show certain teams of chauffeurs (for example, young single men) have much more accidents. The even more insurance coverage you get, the higher the costs will certainly be.

For insurance policy holders that maintain good driving documents. Offered to young drivers that maintain a "B" average or better. For vehicles operated less than a provided number of miles annually, usually 7,500. Provided to motorists over a certain age, usually 50. Given when the same business insures greater than one vehicle in your family.

The kind and also amount of discounts offered may vary by business (liability). Some discount rates affect a part of your protection; various other discounts may impact the whole costs. If you increase your insurance deductible, you may have the ability to considerably reduce the cost of coverage; but you will certainly pay more out of pocket each time you have an insurance claim.

If the insurance policy representative quotes the premium incorrectly, the correct amount figured by the insurance company is the cost you will in fact be called for to pay. As a result, before you change companies, ask the agent to send a application for you (affordable). With a application, there is no protection as well as you pay.

You must not owe a superior costs for previous insurance policy protection throughout the previous 36 months. Your car has to be safe to drive.

Operating a motor car without insurance coverage might result in a penalty of approximately $500. Chauffeurs as well as owners that stop working to show proof of insurance at the time of the stop/accident might be fined as much as $10. Providing proof of insurance coverage that is located to be illegal may lead to a penalty of approximately $5,000.

Ohio's Minimum Coverage Requirements For Auto Insurance Things To Know Before You Buy

It is feasible to buy even more insurance coverage protection than the minimal level of coverage required. Liability insurance coverage safeguards you only if you are accountable for a crash as well as pays for the injuries to others or damages to their residential or commercial property.

What various other sorts of coverage can I buy? Motorists that desire to secure their cars versus physical damage can require to buy: This coverage is for damage to your vehicle arising from a collision, no matter that is at fault. It offers repair of the damages to your car or a monetary settlement to compensate you for your loss - vehicle insurance.

- This pays for dealing with injuries to you as well as your guests regardless mistake. It additionally spends for dealing with injuries arising from being struck as a pedestrian by a car. What is an insurance deductible? Your car insurance coverage deductible is the quantity of money you need to pay out-of-pocket prior to your insurance policy compensates you.