liability cheap car insurance insurers

liability cheap car insurance insurers

Given that every state has its very own electric motor vehicle regulations as well as guidelines, rate increases aren't consistent. credit score. And rates likewise differ depending on the intensity of the crash.

This includes bodily injury responsibility and also residential or commercial property liability, and also in some states likewise includes uninsured driver protection and also injury protection. Each state establishes its own minimum amounts of insurance coverage. Also without comprehensive as well as accident insurance coverage, your prices will enhance from an at-fault accident. This is since you, as a driver, are still a threat - cheap.

vehicle insurance companies cheaper car cheapest

vehicle insurance companies cheaper car cheapest

Also with a larger costs increase generally, you'll still pay a lot less yearly than you would certainly for complete protection following a crash (prices). Ordinary yearly premium with clean driving history Average yearly costs with one at-fault accident, States with the most affordable premium boost after an accident normally have laws that prefer the motorist over the insurance company. automobile.

If you have a $200 or $500 insurance deductible, increasing it to $1,000 or even more can lead to significant financial savings. Yet just do so if you recognize you 'd be able to pay the greater deductible in the event of a future insurance claim - affordable car insurance. If you have full insurance coverage, consider going down accident and also detailed.

Unknown Facts About So You've Had An Accident, What's Next? - California ...

An additional insurance provider might offer much less weight to your recent crash than your existing one. If you want to remain with your present insurer, a fast call to your agent might disclose additional discounts that can cut off some premium.

In the long term, work towards coming to be a more secure chauffeur, and likewise toward enhancing your credit history score. Both of these goals will imply lower prices in the future.

It is usually tough to say who's at fault in a crash, which may impact your rate too. Partial responsibility may need your insurance firm to subrogate, or look for payment from the other driver's insurance company and also they might wish to pass that price on to you. If your insurance firm has placed you in the risky group, our suggestions on minimizing premium costs noted above might be beneficial.

Shopping around or selecting a risky insurer might provide you a reduced rate. If you're wondering exactly how much insurance coverage prices raise after a mishap, the solution is that it relies on your business, the state you live in as well as extra. The national typical boost for chauffeurs with full insurance coverage is 34%; it's an also higher 44% if you have minimum protection (insurance companies).

Unknown Facts About Do Auto Insurance Premiums Go Up After A Claim? - Iii

vehicle insurance cheapest car cheapest car money

vehicle insurance cheapest car cheapest car money

The boost needs to drop from your account in 3 years. Protection utilizes Quadrant Details Services to assess priced quote prices from countless postal code in all 50 states, utilizing the top 15 insurance policy service providers to establish the ordinary auto insurance costs. insure. Quoted prices are based on the account of a three decades old male and lady with tidy driving documents and good credit rating.

Everybody recognizes that a car accident can damage your insurance costs equally as drastically as the mishap harmed your auto. Typical premiums can boost by thirty percent or even more after an accident (credit). So, just how is all this calculated? Price Essentials Any type of quote for cars and truck insurance policy will certainly start with your driving document and the make and design of your auto.

vehicle insurance cheap insurance cars risks

vehicle insurance cheap insurance cars risks

Kind of Automobile The even more pricey the car is, the more expensive the insurance coverage will certainly be. This reality is just reflective of the higher cost of fixings to an extra expensive automobile. Naturally, the a lot more pricey, higher horsepower car is usually driven by younger, much less risk-averse drivers, also adding to the base rate.

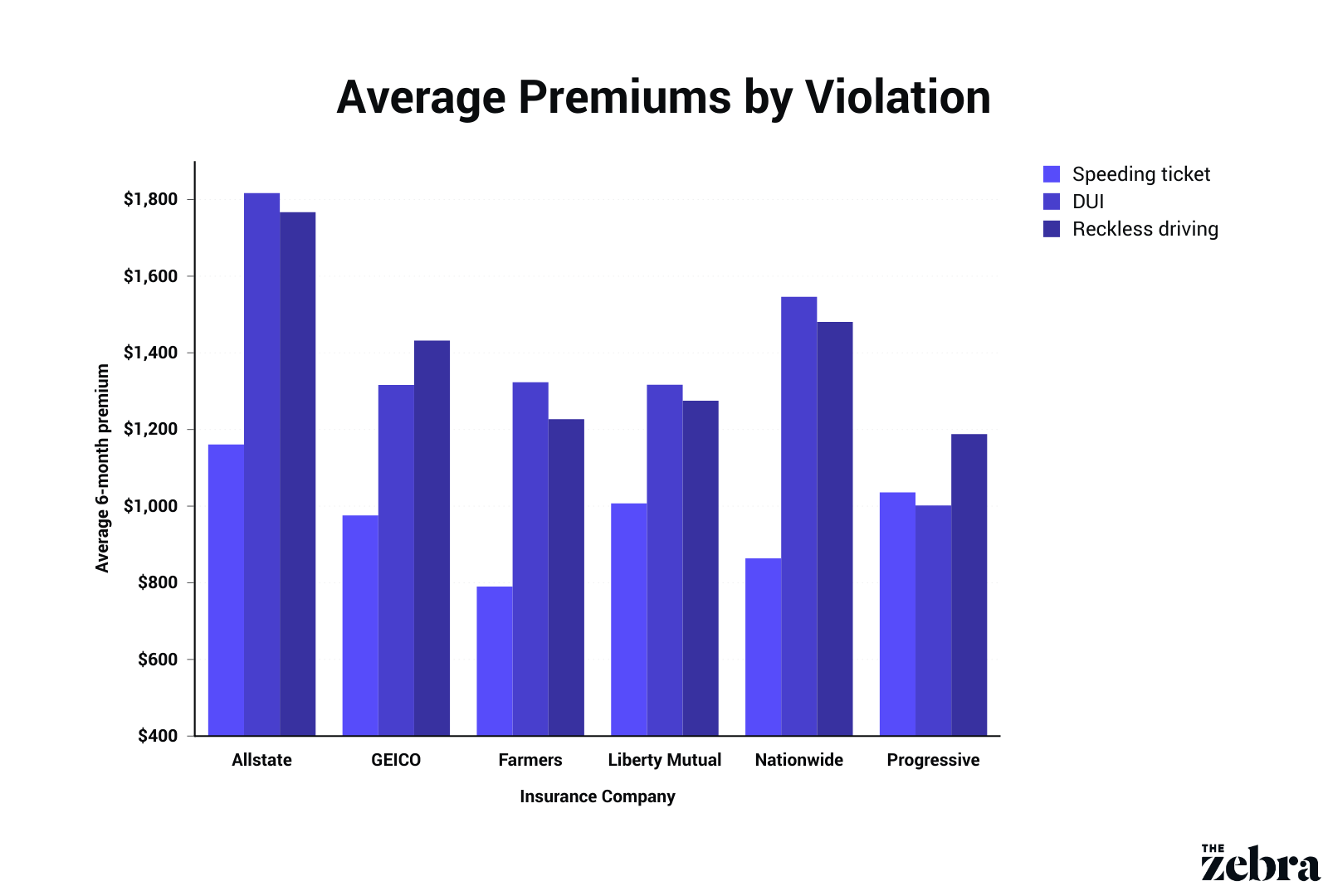

Driving Background If you have had accidents or serious traffic violations, your insurance coverage rates will be significantly greater than the base rate. The insurance coverage company will certainly ask regarding every one of these products on the insurance coverage application as well as confirm them by inspecting your driving history. If you have recent citations or crashes, be planned for greater costs. auto insurance.

What Affects Car Insurance Rates? Factors That Cause Higher ... Things To Know Before You Buy

What Does A Crash Do?, even one that is not your mistake, could boost your insurance costs.

The premium boosts additionally vary by business and variety from a low of 10 percent with State Farm to a high of 36 percent with Amica. In various other words, there will certainly be anywhere from a considerable to a devastating boost in the quantity of your premium (car insured). And, it won't be for simply one year.

In The golden state, many crashes as well as minor infractions influence your rates for three years. A lot more severe concerns can impact them for as much as 10 years. Even if you weren't to blame, if the damage was greater than $1,000, you need to report the mishap, and also it will certainly affect your insurance coverage. auto insurance. In Florida, on the various other hand, a collision strikes your record only if you were issued a citation.

auto insurance insurance companies automobile insurers

auto insurance insurance companies automobile insurers

Massachusetts restricts consideration of an at-fault accident to no more than five years - cheaper cars. The insurance provider may also pick the length of time it will certainly factor a crash right into your premiums, as long as it does not exceed the state maximum. They deal with these issues by asking if you have had an accident within so many years and also, individually, whether you have had a DRUNK DRIVING, usually for a more extended period.

How Much Do Car Insurance Premiums Go Up After An ... Fundamentals Explained

Yet, that again relies on the state as well as the business. USAA, insurance provider to the armed forces as well as their families, states if they concur you are not at fault, your costs will certainly not be influenced. Normally, any type of https://auto-insurance-houston-tx.s3.ams03.cloud-object-storage.appdomain.cloud exceptional rise will only last for 3 to five years, as always, depending upon the state and also the firm.

Various other claims that can substantially affect your premium are at-fault crashes where the crash triggers you injury, at-fault crashes where the vehicle is amounted to, as well as without insurance chauffeur insurance claims. Accident Forgiveness Programs Numerous insurance providers supply drivers with a clean history a mishap mercy program that enables at least one mishap without a rate increase.

This material is meant for basic info just. It does not broaden protection past the policy contract. Please describe your plan contract for any particular info or concerns on applicability of protection - insurance affordable.

Lots full tabulation, As if recuperating from a crash isn't already unpleasant enough! If you enter into an accident and also you're at fault, there are still some strategies you can use to minimize its effect on your cars and truck insurance policy costs. The most effective program of activity is to shop about and also try to find a better rate.

Unknown Facts About Why Did My Auto Insurance Rates Change?

If you intend to figure out exactly how an accident can affect your vehicle insurance, kept reading. Does insurance policy rise after a crash? Whether or not your insurance costs will certainly boost relies on that's at fault. cheapest car insurance. If you are not discovered liable in the crash, your insurance coverage provider possibly will not raise your cars and truck insurance coverage.